CFO Lite For Small Businesses

I want my small business to get bigger, but I’m not sure what parts of the business to focus on.

I’m not sure if I should add a new service or hire a new employee.

I want to forecast the future but don’t know how.

I need to stay within budget but don’t really have one.

Where can I save money and be more profitable?

If you had your own CFO, they could answer these questions and way more.

The problem is true CFO accounting services have traditionally only been accessible to larger businesses. This kind of work takes a lot of effort, time, and expertise and that equals…expensive. Historically, small businesses have only had two options: 1. Go by gut instinct or 2. Pay more than is feasible at a high risk.

Zen Digits has introduced a middle option for small businesses, CFO Lite.

What Makes It “Lite”?

Simple. We only address the most important issues you have. Instead of saying “our CFO services encompass these 12 services…”, we say “we’ll provide these 3 services you’ve identified as most important…”. The services themselves remain highly robust; we are just eliminating the stuff you don’t find valuable.

I have bookkeeping, how is this different?

Bookkeeping is crucial for understanding the financial health of your business and ensuring you are prepared for tax season. It involves recording transactions, organizing receipts, managing bank statements, tracking payables/receivables, preparing financial statements and the like. It’s more science than art, and it’s almost always focused on what’s already happened.

CFO and advisory type work is different, it is focused on making better decisions for the future. It’s about 50/50 art and science. There are math and statistical equations we use, as well as technology and that fulfills the science part. The art comes with knowing what data to use, business acumen and experience, and knowing what the information means and how to implement it in your business.

What Types of Services are available to my small business?

Sampling of what your Lite CFO can do for you:

- Creating budgets and comparing to actual performance

- Accounts Receivable Services

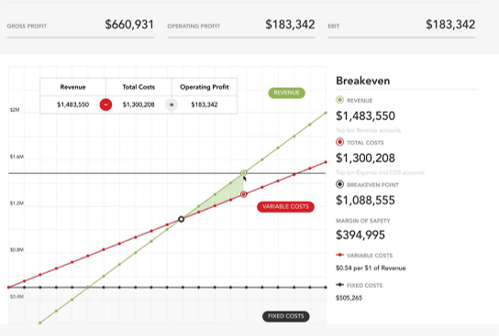

- Financial Analysis: In-depth analysis of financial data to provide a clear understanding of a business’s financial health

- KPI Analysis and Tracking of the goals and metrics important to your business

- Cash Flow Forecasting and Analysis

- Profit and Loss Reporting: Comprehensive profit and loss statements that provide insights into revenue, costs, and profitability

- Balance Sheet Analysis: Detailed examination of your company’s assets, liabilities, and equity to understand its financial position

- Benchmarking Reports: Comparing your performance against industry standards or competitors

- Consolidated Reports: For businesses with multiple entities, a single, unified report

- Customizable Management Reports for investors or banks

- Scenario Analysis: Tools to explore and report on various financial scenarios, aiding in decision-making

- Cash Flow Forecasting: Projections of future cash flow based on historical data and assumptions